By becoming a member of our site, you can add the content you like to your favorites, and present the content you have produced or liked on the internet to our site visitors with the send content option.

Zaten bir üyeliğiniz mevcut mu ? Giriş yapın

By becoming a member of our site, you can add the content you like to your favorites, and present the content you have produced or liked on the internet to our site visitors with the send content option.

You Can Benefit from All Options Exclusive to Our Members by Registering

Next Content:

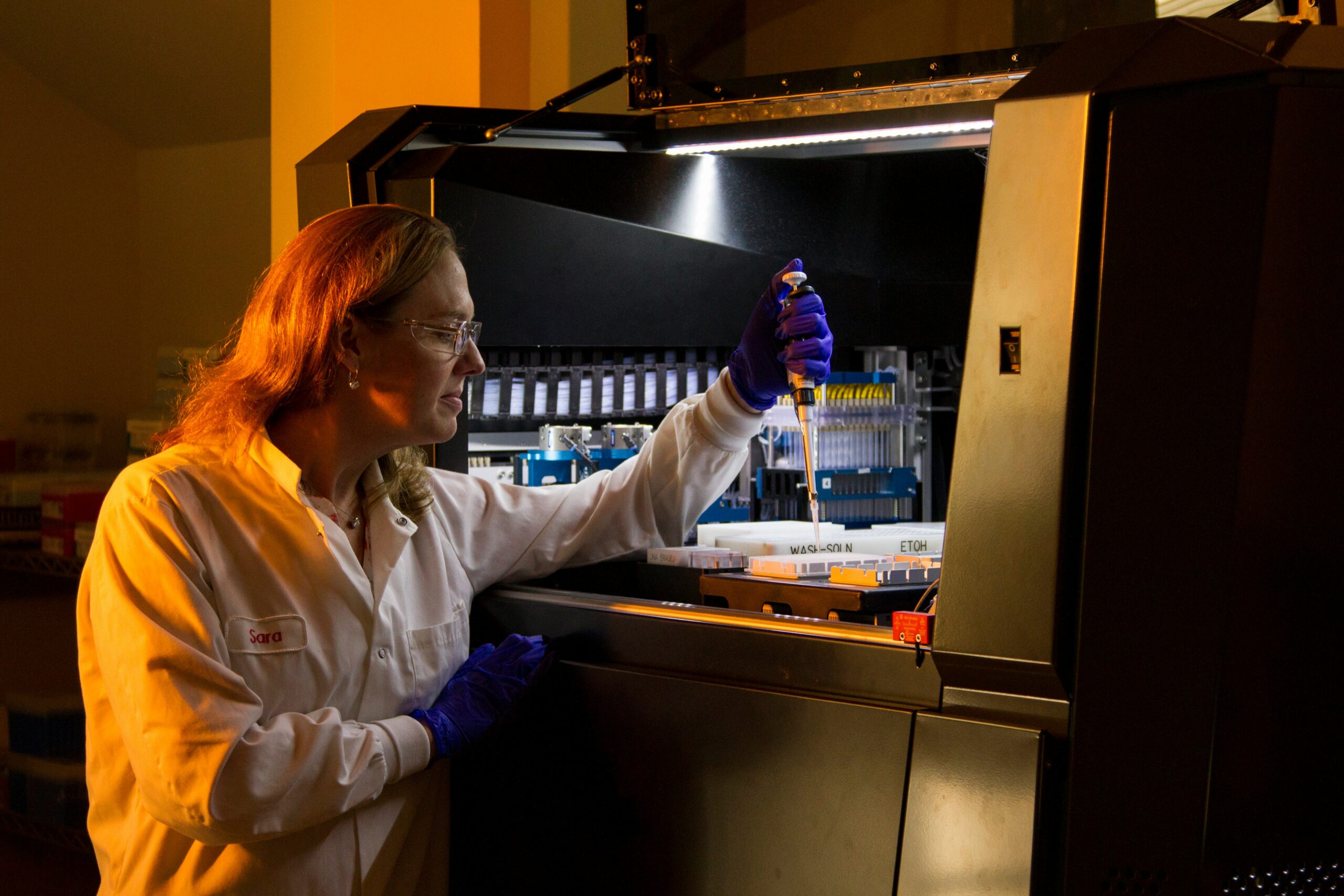

Biotech Industry Trends and Forecasts

How Foreign Investors Influence the Japanese Stock Market

Foreign investors play a crucial and multifaceted role in the Japanese stock market, profoundly influencing its dynamics, volatility, and overall performance. Their impact is felt through various channels, including capital inflows and outflows, investment strategies, corporate governance demands, and the introduction of a global perspective to market operations.

One of the primary ways foreign investors affect the Japanese stock market is through capital inflows and outflows. When foreign investors are confident in Japan’s economic outlook, they channel significant amounts of capital into Japanese equities. This influx of funds not only drives up stock prices but also enhances market liquidity. Increased liquidity makes it easier for other investors to buy and sell shares, contributing to a more efficient market. On the other hand, if foreign investors become wary due to economic uncertainties or geopolitical tensions, they may pull their capital out of the market. Such capital outflows can lead to sharp declines in stock prices and reduced liquidity, creating a more challenging environment for domestic investors.

Foreign investors often employ sophisticated investment strategies that can significantly impact market trends. Many institutional investors from abroad use algorithmic trading and high-frequency trading techniques, which rely on complex algorithms and high-speed transactions to capitalize on minute price differences. These strategies can lead to increased market efficiency by narrowing bid-ask spreads and enhancing price discovery. However, they can also contribute to higher volatility, as rapid trading can amplify price movements, especially during periods of market stress.

In addition to their trading strategies, foreign investors bring diverse investment philosophies to the Japanese market. While domestic investors may have a longer-term, more conservative approach, foreign investors often pursue a variety of strategies, including value investing, growth investing, and momentum investing. This diversity can introduce new dynamics to the market, influencing how stocks are valued and traded.

A significant impact of foreign investment is seen in the realm of corporate governance. Foreign investors typically demand higher standards of transparency, accountability, and shareholder rights. To attract and retain foreign investment, Japanese companies have increasingly adopted better governance practices. This shift has led to more robust corporate structures, improved management practices, and greater emphasis on shareholder value. Enhanced corporate governance not only benefits individual companies but also contributes to a healthier and more resilient stock market.

Foreign investors also infuse the Japanese market with a global perspective. Their investment decisions are influenced by global economic trends, currency fluctuations, and geopolitical events. For instance, fluctuations in the yen’s value can significantly impact foreign investment flows. A weaker yen makes Japanese assets cheaper for foreign investors, potentially leading to increased inflows. Conversely, a stronger yen can make Japanese assets more expensive and less attractive. Additionally, global events such as changes in US monetary policy, European economic conditions, or geopolitical tensions in Asia can all affect foreign investors’ behavior in the Japanese market.

Furthermore, foreign investors can act as a bridge between the Japanese market and other major markets around the world. Their activities often lead to greater integration and correlation between the Japanese stock market and global markets. This integration means that events in other parts of the world can have a more immediate and pronounced impact on Japanese equities. For example, a financial crisis in Europe or a trade policy change in the US can quickly ripple through to the Japanese market due to the interconnectedness brought by foreign investors.

Foreign investors also contribute to the diversification of the Japanese stock market. By investing in a wide range of sectors and companies, they help to spread risk and reduce the market’s reliance on a few dominant industries. This diversification can enhance the market’s stability and resilience, making it more attractive to a broader range of investors.

In conclusion, foreign investors are a vital and dynamic force in the Japanese stock market. Their influence extends through capital movements, sophisticated investment strategies, demands for improved corporate governance, and the introduction of a global perspective. Understanding the behavior and preferences of foreign investors is essential for predicting future market trends and making informed investment decisions in Japan’s stock market. Their presence not only shapes the market’s direction but also contributes to its overall health and integration into the global financial system.

We offer our respects and wish you a good reading. – Who Learns What? Team

- On-Site Comments